What’s the Opportunity?

The IRS allows businesses to deduct the full cost of qualifying vehicles in the year they’re put into service, instead of spreading depreciation over many years. For 2025, that means big tax savings for heavy-duty trucks, vans, and work vehicles you buy from us.

Which Stellantis / Ram Vehicles Qualify?

How It Works

- Section 179 lets you write off up to $2,500,000 in qualifying equipment/vehicles in 2025.

- Bonus Depreciation (100% this year) covers the rest, so many businesses can deduct the entire cost in year one.

- Vehicle must be used 50% or more for business.

Real-World Example

Buy a Ram 2500 work truck for $80,000 in 2025:

- You may be able to deduct the full $80,000 on your 2025 taxes.

- That’s money back in your pocket now, instead of spreading over 5+ years.

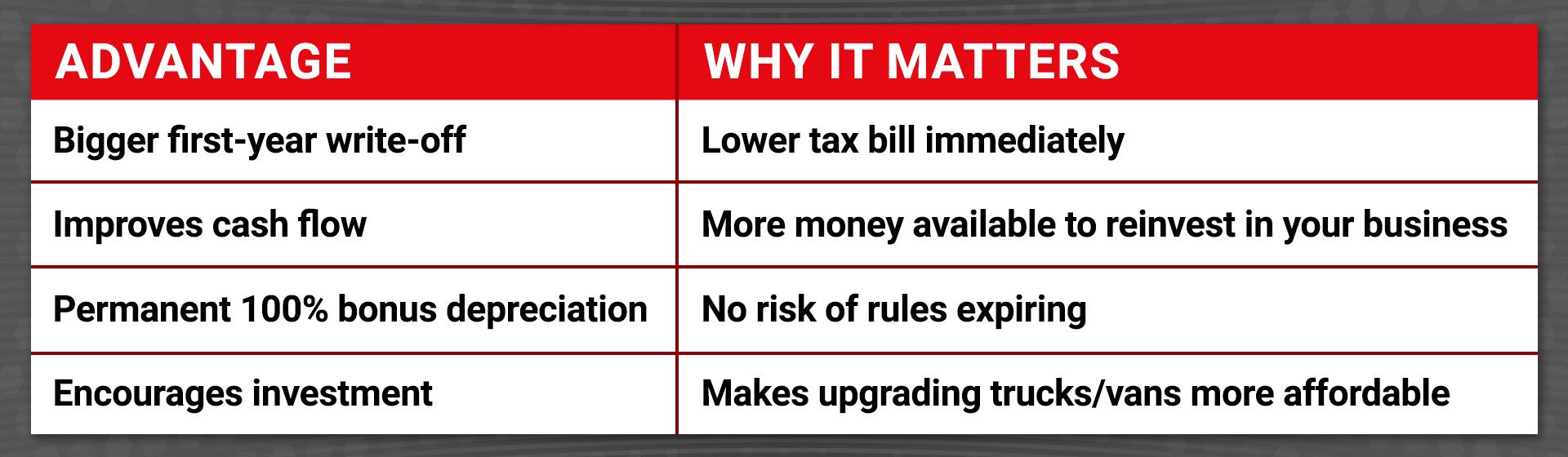

Key Advantages:

Lease vs Purchase

- Purchases (cash or financed) usually qualify for Section 179 and Bonus Depreciation.

- Most standard leases do not qualify (you can deduct lease payments as an expense instead).

- Some lease-to-own or capital leases may qualify — ask your tax advisor.

Business Name / LLC Requirement

- To maximize deductions, title and insure the vehicle in your business or LLC name.

- If purchased personally, you can still deduct the business-use portion, but detailed mileage logs are required.